Once new investors finally jump into the stock market and buy their first shares in a company. The next question they usually have is, when should you sell a stock? This is a crucial part of investing. It is not only the point where you make the money from your shares. It is also the point where you can get yourself out of trouble and ultimately save a lot of money too. I believe there are 3 good reasons to sell the shares you own…

1. Change In The Fundamentals

One reason to sell the shares you own would be if something in the company has fundamentally changed. Henceforth making it no longer a good investment. Ill give a few examples:

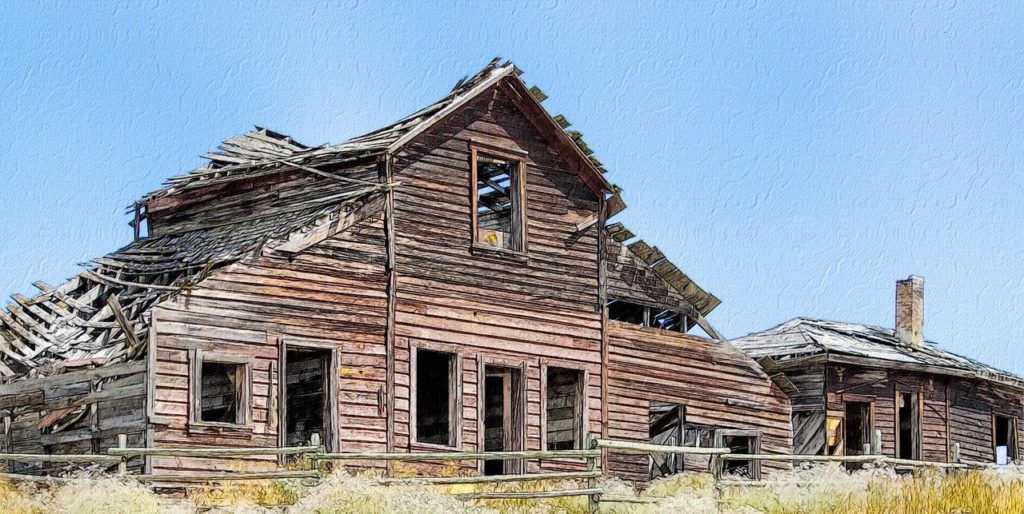

Say you own a property investment company focusing on commercial properties and office space. If the trend changes to more people working from home or remotely which is possible after this coronavirus pandemic, this will make the future profits of the company not look so appetising.

Another example would be if you owned a public transport company. Then new competition pops up in this industry, providing super cheap transport to everybody. This new competition will impact their future market share and the company’s future prospects decrease.

One more example may be perhaps if you owned a stock in the mining industry. They previously had a great management team, but now they have retired and new company leaders have taken their place. These new members don’t share the same vision for the company as the previous management and future growth now doesn’t look as likely.

This is why it is important to keep track of your stocks once you buy. Situations will always be changing within a company. It is important you know what is going on with each one. If things change for the company in a bad way and you no longer believe the company will grow like you once thought it would, then this is a good reason to sell a stock. Then look for a better investment to put your money into.

2. The share price has become overvalued

As described in the post ‘When Should You Buy A Stock’, you want to be well aware of the company’s valuation, even after purchasing. You should check back on the valuation ratios (P/E, PEG, P/S, P/B). This is to make sure the share price isn’t far exceeding the actual performance levels the company is doing.

To do this you should be aware of the companies usual numbers for these ratios. Be aware as to whether the current ratio values are by far exceeding this level. It may also be useful to compare these ratios to other companies in the same sector. If they are both increasing, maybe this is just a positive sign for the sector in general.

In the long run, the share price of a public company will trace relatively consistently to the actual performance the company achieves. Generally, if the company’s earnings are increasing over time, so will the share price.

However, sometimes we will see inflated prices for certain stocks. This is either due to excitement about their future or hype about something in the news. This increase in share price will increase the price valuation ratios which is a telling sign that maybe you need to sell. Unless the profits of the company absolutely boom like the hype was expecting, then the share price will eventually correct itself to become a more fair value to what the company is worth.

3. You need the cash

Sometimes, you may be in a situation where you have not much cash on the sidelines and you see an amazing investment opportunity pop up. You are sure this is going to be a good use of your money. In this case it may make sense to sell some of your lower performing stocks to use the cash for a new, better investment.

Alternatively, you may be going through some unforeseen financial struggles in your personal life. And you need the cash to cover your expenses or living costs. Or perhaps you just want to spend some of your profits to enjoy what you have worked so hard for.

It is important to remember, at the end of the day, it is your money. You are likely investing to improve your financial situation, so that you can live a more stress free and happy life in future. There’s no use being the richest person in the graveyard. So although you need to be careful not to overspend, you must remember that you work hard in investing so that you can enjoy life a little more in future.

However, that being said, a successful investing strategy is often to invest for the long term. This allows you to see through to the true potential of your investments and to mitigate the short term fluctuation risks that all stocks will incur. If you invest to sell at every little bit of profit you gain, you likely won’t see maximum potential of your investment portfolio.

BONUS TIP:

When you sell a stock, remember, you don’t always need to sell all of your shares. For example, if you are short on cash and need to build some more to give you more freedom in your portfolio. Then you may like to sell some of your shares in a company. Or perhaps, You see the company is beginning to be overvalued but you still think there’s a fair bit of growth left. You may like to sell some shares for a profit. When you sell part of your shares in a company, you take the profits what you want out of the investment. But also, you are still involved with the potential to make some nice gains.

Thanks for reading…

I hope you found this post useful and that you now know when to sell a stock. Remember, don’t let your emotions control your stock actions. You should always look to stick to a controlled strategy. Don’t just sell the stock because the price is going down and its scary. Have a look again, regarding the 3 factors mentioned above. Then see if the company really is worth holding on to.

If you liked this post, you may also like to check out the stock market section of the Money Your Concern website. If you want to dive deeper into investing, you may also find the further learning section helpful. This is where I give reviews and recommendations of the best learning materials I have come across over my progression as a stock market investor.

Best of luck with your future investments. Talk soon.

Harry

That’s great, I hope it helps!!

I used to be able to find good info from your blog posts.