Have you ever thought you should be making more money and creating more wealth than you are at the moment?

Being smart with your money and investing as early as you can is one of the smartest things you can do for yourself and your financial future. Here are 5 reasons why you need to start investing right now!!

1. Allow Compound Interest To Start Early

This is a hugely significant factor in improving your future wealth. Compound interest refers to if you earn a return on an investment after a certain period of time. You then decide to reinvest this return to make an even bigger return. If you repeat this process, your gains become exponentially bigger to reach unbelievable amounts later on.

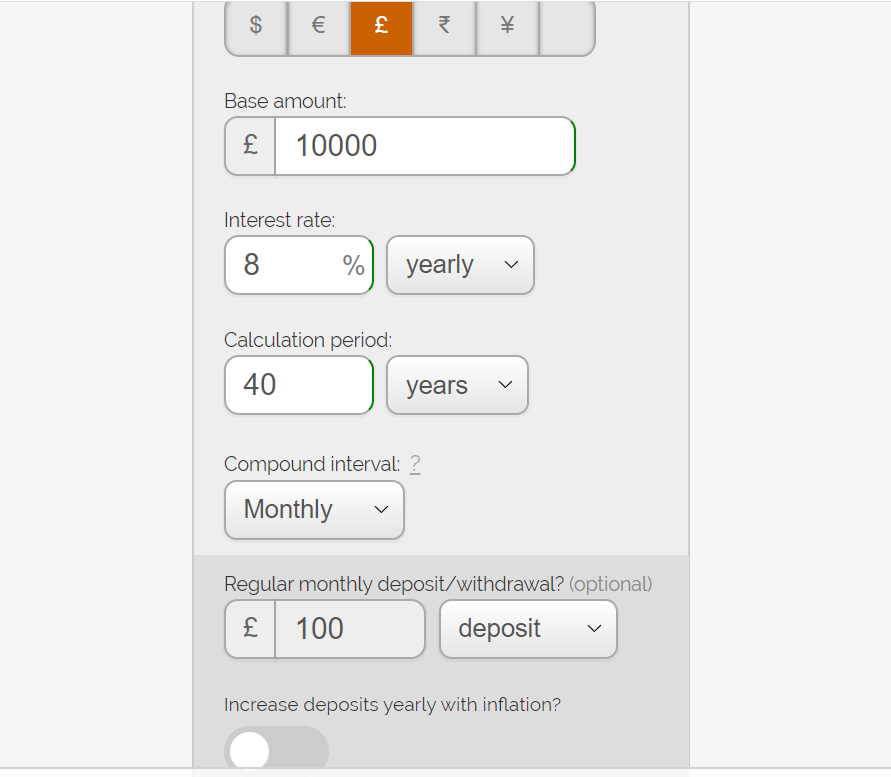

In order to see the true effects of this point I urge you to play around with a compounding calculator. This calculator estimates the wealth you will have after a certain amount of time if you put some money aside and gained a certain % return each year.

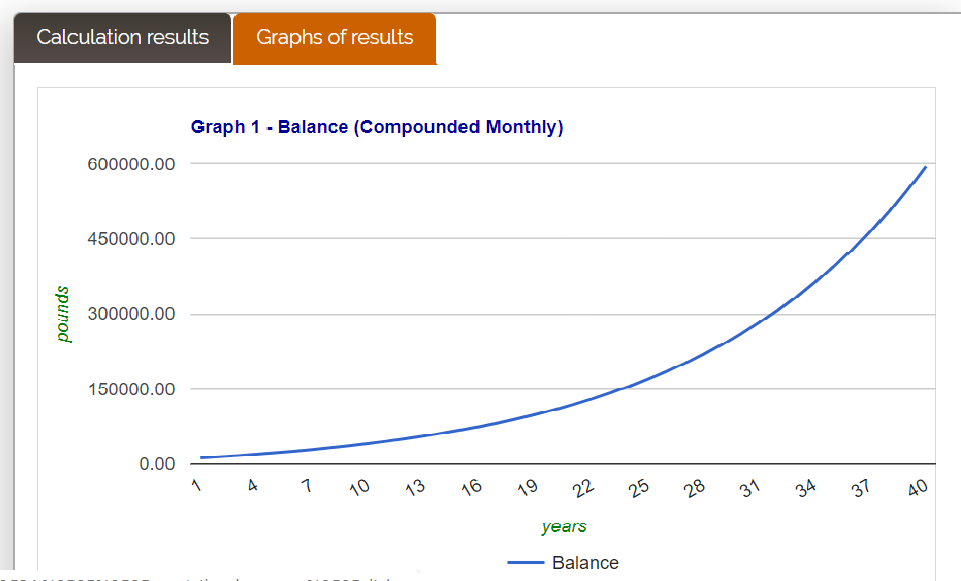

So let’s look at an example here:

The graph above shows, if you were able to start investing at the age of 25, starting with £10,000 and putting aside £100 extra a month (I believe this is pretty achievable). If this was invested at a modest rate of 8% a year return (which is approximately the average return of the stock market each year) with profits reinvested, by age 65, you’d have accumulated £594,162.

Had you started investing with the same strategy 10 years later at age 35 and invested until you were 65, you’d have less than half of the profits at £259,387.

This proves, it is absolutely necessary for you to begin learning to invest and actually invest as soon as possible in order to get maximum gains. Meaning, you need to start right now. Although seeing you are reading this, you obviously are starting your investing journey, well done!!

P.s.

I really recommend playing around with a compounding calculator yourself for inspiration, to see where investing your money can really take you. Imagine if you could make 10% or 12% return on your investments, or could put away more than £100 a month. You’d soon never have to worry about money again.

2. Make Your Mistakes Whilst You Have Less Responsibilities

As investors, we all make mistakes. Especially when starting out, you won’t always choose the perfect investments. You’ll miss out on gains and sometimes even lose money on certain investments. It is important to remember when you are investing your money, your investment can go up as well as down in value.

It is therefore much more beneficial to learn from these mistakes early on, where you have less financial pressures, either from having a mortgage or a family to feed at home. Losing money is always a lot easier when you don’t have as much of it to lose. As long as the loss won’t affect your living standards or the lives of the people around you.

If you’re reading this and you already have a mortgage, have your own family, great opportunities are still there. You can still start investing right now. Although it is recommended you keep aside part of your earnings as an emergency fund. This is in case you are put in a situation where extra funds are required to stay afloat. You don’t want to be in a situation where you need to sell investments early, at a loss, in order to feed your children!!

In your case, it’s always good to work out how much you and your family need to live off a week and keep safe at least 6 weeks of living costs. This way, you can support yourself through your financial struggle without impacting your investments.

For you younger readers, although your living costs are likely to be less, I recommend you do the same. Keep 6 weeks of costs free for the similar reasons. As we all know, life puts us all through difficult times no matter who you are. (Just look at the COVID- 19 outbreak).

3. Knowledge Is Power

The quicker you can get into the investment game, the quicker you can start learning how to invest your money most effectively. Developing the strategy that works best for you, within your interests, temperament, special knowledge etc.

The best way to really learn something is to get involved and actually get started. Hopefully, after reading this post you will be inspired to finally start investing yourself. Here on moneyyourconcern.com, we plan to post loads of content on different types of investing. There are also plenty of resources and other online sites which you will be directed towards on this website.

Online, you will learn everything you need to know about investing money. Once you have this baseline knowledge, I believe the best way to learn is to choose a strategy you like and get your feet wet with a relatively insignificant amount of money to begin with.

I also welcome you to use the comments section below to ask questions about different investing strategies. This would also be a great place to discuss with others, ways to approach this and get started according to your various lifestyle situations. I look forward to hearing from you!!

4. Investments Are Likely To Be Cheaper Now Rather Than Later

The average rate of inflation in most countries is often around 2-3% a year. This means the value of the money you own now will have less spending power in future. Holding cash (meaning non-interest making money you own) is one of the worst things you can do for your financial future.

In general, over the past 30 years the stock market prices have risen by over 400%. Over the same period of time, UK house prices have increased 428%. This massively beats the rate of inflation. It also shows that the price of investments in general are frequently higher over time. So more than likely, the sooner you get investing, the sooner you will increase your wealth and stay on top of inflation.

Although it is useful to note, the price of certain investments will fluctuate at certain times. This is due to different levels of supply and demand. For example, in a time of nationwide financial difficulty, prices of shares in the stock market will drop drastically. It is a useful skill to be able to recognise when investments are becoming overpriced and will likely come down due to their lack of affordability or relevance to current performance.

Although this fluctuation does happen, in the long-run, the stock market increases on average, around 8% a year. This means, if you invest now and hold your money in that investment more than 5-10 years, you are likely to beat inflation and build wealth regardless of short-term occurrences. As long as you make wise choices on your investments.

So in summary, start your investment journey, whilst investments are cheaper. Good investments now are likely to be much more valuable in the long run.

5. The Earlier You Start investing, The Faster You Can Reach Financial Freedom

Remember reason number 1? the power of compound interest means that the value of investments reinvested will grow exponentially. So Investing even 5 years earlier will mean you have far greater wealth than later investors.

As the value of your investments grow, so will your passive income from dividends or rental income. As this grows more and more rapidly, you could eventually reach a point to where this income can cover the costs of your living. Leaving you in a place where you no longer need to work to live. From here, you have the ability to choose what you do with your day. It doesn’t matter if you go to work, or if you go to the beach, you can do what you like.

This is financial freedom!!

Whether you aspire to reaching financial freedom or simply to just have less financial pressure in your life, investing is an absolute must. As shown through these 5 points, sooner, is definitely better than later to get started. Even if it means putting away a small amount of money each month.

If this has inspired you to take action and start investing, GREAT! Keep posted with Money Your Concern where we guide you on how to be a successful investor using different strategies. Best of luck with your investing journey.

Thanks for reading. Talk soon.

Harry

Hi! I just would like to give you a huge thumbs up for your

excellent information you’ve got here on this post. I will be coming back to your site

for more soon.

Hi! This is my first visit to your blog! We are a group of

volunteers and starting a new initiative in a community in the same niche.

Your blog provided us useful information to work on. You have done a wonderful job!

Hi i am kavin, its my first time to commenting anywhere, when i read this piece of

writing i thought i could also create comment due to this good article.

Hello There. I found your blog using msn. This is a very well written article.

I will make sure to bookmark it and return to read more of your useful info.

Thanks for the post. I’ll certainly comeback.

This site was… how do you say it? Relevant!! Finally I

have found something that helped me. Thank you!

my homepage nordvpn special coupon code

Hola! I’ve been following your weblog for a long time now and finally got the bravery to go ahead

and give you a shout out from Austin Tx!

Just wanted to mention keep up the great work!

Here is my website :: eharmony special coupon code 2024

I just couldn’t leave your site prior to suggesting that I

actually loved the standard info an individual supply on your visitors?

Is gonna be back ceaselessly facebook vs eharmony to find love online inspect new

posts

I am curious to find out what blog system you are utilizing?

I’m experiencing some small security issues with my latest

website and I’d like to find something more risk-free.

Do you have any suggestions?

Also visit my homepage – vpn special coupon code 2024

I’m amazed, I have to admit. Rarely do I encounter a blog

that’s equally educative and engaging, and let me tell you, you have hit

the nail on the head. The issue is something which not enough folks

are speaking intelligently about. Now i’m very happy that I came across this during my

search for something relating to this.

My blog – vpn special