Welcome to part 2 of the 3 part value investing basics strategy. The investing strategy I have been learning and using for over 3 years in the stock market. Already, this investing strategy has given me nice profits and at the same time, exposed me to only a small amount of risk.

Before reading this, be sure to check out:

- Part 1- 3 Tips For Value Investing Basics

- And afterwards find part 3 here- 3 Tips For Reducing Risk In The Stock Market.

Part 2 will teach you to Maintain your stock market portfolio by focusing on 3 strategies required to keep on top of your stocks once you start buying good companies. Once you buy, you can’t just leave your portfolio the way it is, there’s still work to be done. The tips below will teach you to keep on top of your investments. Also, to know what to do with the profits you make for best future returns.

4. Keep Researching Your Stocks:

Once you buy shares of a company, it is great practice to buy with the intention of holding for an extended period of time to overcome volatility. However, many investors stop there. They buy and hold and sometimes miss out on the prime opportunities to either sell or buy more shares in the company.

Sometimes changes happen to a company, for the better or for the worse. The only way to know is to keep track of every stock you own. Jim Cramer in one of his books stated to spend at least 1 hour a week keeping up to date for each company you invest in. This will include keeping track of the news for each company, any new announcements they make, their recent earnings reports and even general news in the companies particular sector.

In general, there are 2 trends of information you are trying to gain from this research…

- To see if the latest reports show that the company is still on track or going to do better in future. In this case, you want to be looking at buying more shares if the company is still cheap. Or it may give you confidence to hold the shares for a longer period of time to see greater gains before you sell for a profit.

- Alternatively, to see if this news will have a detrimental effect on the company in the future. In this case, you should be looking to sell. Even if this means you’ll take a small loss. If the company isn’t worth what you once thought it was, you’re just saving yourself from larger losses in the long run.

Not keeping up to date with your stocks can have a detrimental effect on your profits. It could cause you to hold onto a dieing stock, or to sell unreasonably if the share price falls for only a short-term reason. This research will help you look at the stocks you own as businesses and you won’t make moves simply off of its share price. Share prices fluctuate naturally but over the long run, good stocks will make a nice profit. You just need to make sure they stay good stock to be holding.

5. Always Keep Some Cash:

So you’ve listened to what I’ve said. You maintain your stock market portfolio by keeping track of each stock you own. Now imagine a great opportunity arises. An event happens in the economy causing many people to be scared and sell out of all stocks. However, this event has no impact on the future business of the company you own shares in. It is still as promising as it once was yet the share price is an absolute bargain.

This is a once in a lifetime opportunity. The shares may never be this low again. So you rush over to your account to buy some more share looking for some certain long-term future gains. Till you notice, You’ve spent everything already on buying good stocks…

This is never a good situation to be in. In the long-term, if we choose great companies, we can be almost sure that their shares will go up in value as they become more profitable over time. However, in the short-term stocks are unpredictable. Because of investors emotions, stock prices can fluctuate wildly, especially in times of uncertainty. This is why its such a great idea to always have some cash behind. Just like point 2 made in the previous post, you can cost-average down your buy price for these great stocks. The lower your average cost, the more profits you’ll make when the share price grows in future.

The amount of cash you should hold back depends on certain scenarios in the stock market…

- If stocks in general are starting to get expensive, then it could be a good idea to hold back around 30-40% of your portfolio in cash. Then wait for the prices to correct themselves and buy in when they become more fairly valued.

- If stocks are in general on the cheaper side, then you may look to have 10% or less in cash in order to make the most of the cheap opportunities going on.

*NOTE* When I say cash, I mean money that is not-yet invested in your account (liquid asset). Not cash which is stashed under your mattress at home. That’s no good to anybody!!

6. Improve Your Future Profits By Reinvesting Your Dividends:

Some companies Keep all of their profits to reinvest in the company to improve future growth. These companies are often faster growers and you’d expect more profit in capital gains. However, other, often larger companies may have little room for growth. These companies will prefer to give their shareholders a return through paying a dividend.

The beauty of this dividend is the ability to unleash the power of compound interest!!

If you reinvest this dividend back into buying more shares, your future gains and dividends will become greater. And invest these increased dividends into buying even more shares, your profits will become even greater. Repeating this process for an extended period of time sees exponential growth in your profits to levels you cannot believe. This is known as compound interest.

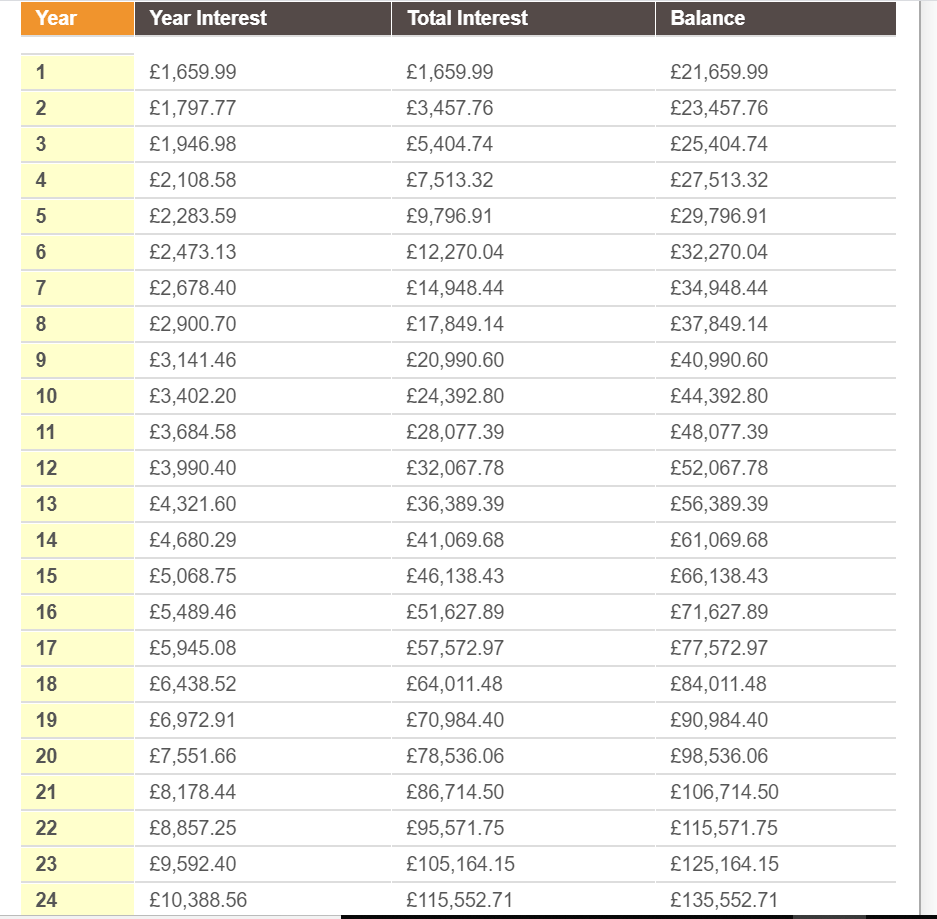

See here for an example…

The table above shows if you invested £20000 at age 25 and gained 8% a year interest (the stock market historical average) with no added investments. If you reinvest your profits each year, before the age of 46 you’d have £100,000. By 65 you’d have £485,468.

It is amazing what you could achieve with compound interest and is one of my largest factors giving me hope to achieving financial freedom. I entice you to play around with a compound calculator. There you’ll see what financial situation you could be in if you maintain your stock market portfolio well over the years.

I hope This Helped…

Thanks for reading 3 more tips to be a successful value investor. I hope by now you have a better idea of how to maintain your stock market portfolio. Meaning you know how to invest with reduced risk and maximum future gains.

Don’t forget to check out part 3 of my value investing basics series. There you will find out 3 more tips for reducing risk in the stock market. If you’re keen to get involved and learn more about the stock market, be sure to check out the investing section of the Money Your Concern Website. Here we aim to post lots of useful content in future about successful stock market investing.

I’ve been investing for over 3 years now and it is a great way to increase the profits I make at work. Stock market investing will be of paramount importance to me through the £1 a day challenge I have devised to get me out of my comfort zone to get started in online business. I will invest the profits I make online in order to eventually lead a life of financial freedom. A life where I can choose if and when and where I want to work. Where I can live the life, I want lo lead; not what my employer wants.

If you share a similar dream to me, be sure to check the £1 a day challenge out and see if it can help you get on track to a financially successful future yourself.

I hope you found value out of today’s post. If you did, let me know in the comments below, I’d love to hear from you and any questions you may have!!

Thanks, talk soon.

Harry

Pingback: 3 Tips To Reduce Risk In The Stock Market | Money Your Concern

Pingback: 3 Tips For Value Investing Basics | Money Your Concern